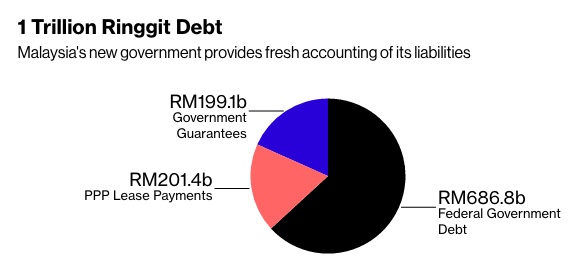

Malay Mail insists Malaysia’s debts is RM1 trillion and not RM700 billion

(MMO) – With a massive RM1 trillion debt and liabilities hanging over Malaysia, Tun Dr Mahathir Mohamad will be using the United States as his stage to court global investors when he visits New York to address the United Nations General Assembly next week.

He is finally making his first official visit to the US four months after returning as prime minister for a second time, and his office has been busy arranging meetings with both global equity and fixed-income investors who remain skittish of Malaysia after the scandal-tainted 1Malaysia Development Berhad (1MDB), UK-based Financial Times (FT) reported.

After his address in China last month, the indefatigable 93-year-old is expected to continue to play a central role in reshaping Malaysia’s financial and economic policies to allay concerns of institutional corporate corruption.

“There was a lot of scepticism about governance when it came to the Najib government and the 1MDB scandal and to what extent it had permeated down to corporate Malaysia,” Medha Samant, investment director of Asian equities at Fidelity, a US-based multinational investment company, told the British paper.

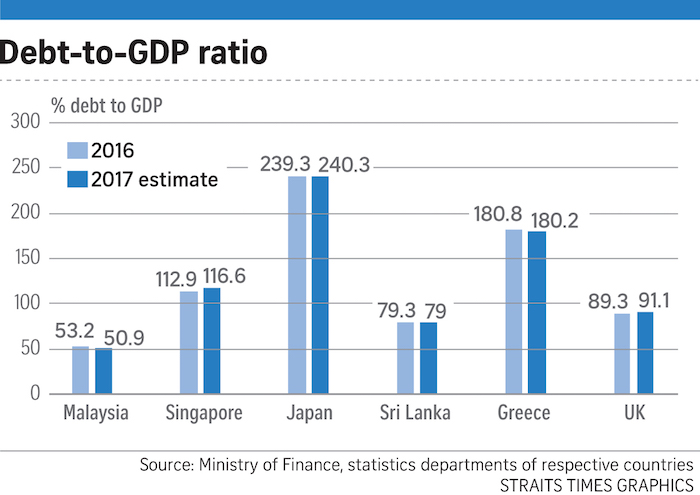

Straits Times Singapore’s report on debt to GDP ratios for six countries

She added investors do not have enough information to be optimistic about the new Pakatan Harapan (PH) administration.

There is insufficient information “to warrant any optimism” about Malaysia’s new administration just yet, Samant added.

Dr Mahathir has a chequered history as prime minister. His first administration from 1981 to 2003 was seen to adopt populist economic measures, according to FT, which is why major investors remain wary.

The paper said global investors’ exposure to Malaysia account for just 1.56 per cent in the emerging markets, adding that interest in neighbouring Indonesia is three times the size of Malaysia’s, despite the rupiah’s performance.

Their eyes are also on Malaysia’s fiscal deficit. FT suggested that the government could come under pressure to bring back subsidies after it repealed the unpopular Goods and Services Tax (GST).

However, Dr Mahathir appears to be making an effort to redress this.

Citing the Prime Minister’s Office, FT reported that investment funds dealing with large emerging market portfolios, such as Fidelity and Franklin Templeton, as well as US manufacturers with operations in South-east Asia, have been approached to meet with Dr Mahathir during his New York trip.

JPMorgan, the world’s sixth largest bank and the largest in the US, has also been roped in to organise meetings with New York financial movers and shakers, FT reported.

“Prime Minister Mahathir will be involved in all these things. They were very specific about who they want to see and it is definitely him,” the British publication quoted the Prime Minister’s Office as saying.

Malaysia needs new sources of revenue urgently after cancelling the three billion-dollar pipeline projects previously awarded to China firms and is trying to terminate the East Coast Rail Link.

Billions of ringgit fled the local capital markets following the 14th general election as investors shifted their funds to safe havens, while Malaysia worked out the first change of government in the country’s history.

Dr Mahathir’s New York trip next week is expected to last three days; he is likely to address the UN General Assembly on September 28, national newswire Bernama reported previously.