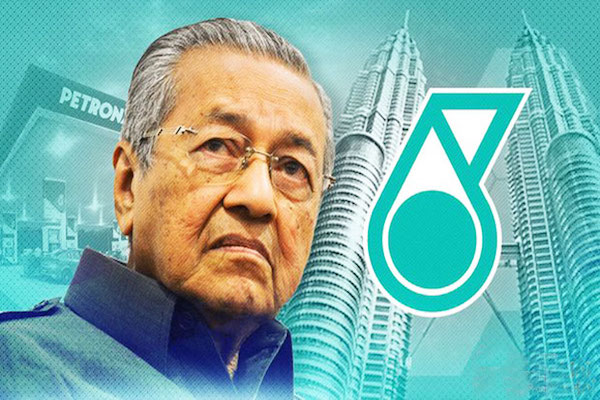

Why Mahathir refuses to increase the 5% Oil Royalty to 20%

The issue is the Prime Minister can just change the 5% Oil Royalty to 20% and no one can do anything about it (just like he changed it from 5% to zero in January 2000). But Mahathir refuses to do that because Petronas cannot afford to pay 20%. Since they have abolished the 6% GST, the money to run the country now has to come from Petronas. If they increase the Oil Royalty to 20% then the GST not only needs to be reinstated but it will need to be increased to 12-15% (in the UK it is 20%).

NO NOLDS BARRED

Raja Petra Kamarudin

Azmin lied when he said the 5% Oil Royalty is not really Royalty but is actually a cash payment loosely called Royalty

This was what The Star reported yesterday:

(The Star) – Pakatan Harapan’s election promise of giving a 20% ‘royalty’ to oil producing states was based on a loose definition of the word, said Economic Affairs Minister Datuk Seri Azmin Ali.

“The term cash payment is not used generally, but it is generally understood to mean a royalty. That is why when we drafted Pakatan’s manifesto, we used the term royalty, but not in the context of its dictionary meaning,” he said during his ministerial reply on the motion of thanks on the royal address in Parliament on Monday (Aug 1).

He noted that Section 4 of the Petroleum Development Act (PDA) did not refer to ‘royalty’ as such. Rather, it referred to a ‘cash payment’ of 5% of gross profit per barrel of oil.

In 1976, the Supplementary Agreement stated that the 5% ‘Cash Payment’ is ‘Royalty’

Actually, Azmin is lying. It may be true that the Petroleum Development Act 1974 (PDA) only said that Petronas will make a 5% ‘cash payment’ of the gross revenue to all states that have oil and that the PDA did not stipulate that this 5% ‘cash payment’ is Royalty. However, in the Supplementary Agreement signed in 1976, which is an Addendum to the 1974 Agreement, it clarified that the 5% ‘cash payment’ is Royalty.

In other words, the PDA and the 1974 Agreement just mentioned that the cash payment will be 5%. Then, in 1976, the Supplementary Agreement clarified that the 5% cash payment is Royalty. The 1976 Supplementary Agreement was to make sure that there is no confusion about the 5% that is to be paid — and which was mentioned in the PDA and the 1974 Agreement as cash payment — but did not state that the 5% cash payment is Royalty.

Hence, in 1976, the ‘cash payment’ was confirmed as Royalty.

Mahathir does not need Cabinet approval or to get Parliament to pass any laws to change the 5% Oil Royalty to 20%

Whether Petronas pays 5% or 20% or zero does not need the approval of Parliament or the Cabinet. Petronas actually bypasses Parliament and the Cabinet and reports directly to the Prime Minister. And the Prime Minister can make the sole decision without having to consult Parliament or the Cabinet or get their approval.

In January 2000, the Prime Minister decided to terminate the 5% Oil Royalty to Terengganu. Parliament and/or the Cabinet had no say in the matter and did not need to be consulted. If the Prime Minister can change the Oil Royalty from 5% to zero, he can also change it from 5% to 20%. The Prime Minister does not need approval from anyone or for any new law to be passed by Parliament to make any changes to the Royalty payment.

The issue is the Prime Minister can just change the 5% Oil Royalty to 20% and no one can do anything about it (just like he changed it from 5% to zero in January 2000). But Mahathir refuses to do that because Petronas cannot afford to pay 20%. Since they have abolished the 6% GST, the money to run the country now has to come from Petronas. If they increase the Oil Royalty to 20% then the GST not only needs to be reinstated but it will need to be increased to 12-15% (in the UK it is 20%).

So, you cannot have both. Either you keep the GST and increase it to 12-15%, and pay 20% Oil Royalty, or you remove the GST and pay only 5% Oil Royalty. That means 10 million Malaysians from Sabah, Sarawak, Terengganu and Kelantan are being denied their oil money so that the money can be used to run a ‘tax-free’ country of 32 million people. Is this not the poor people paying for the benefit of the rich people?