Now, please tell us the truth about 1MDB

The 1MDB issue is not about RM42 billion ‘disappearing into thin air’, as what Mahathir said. It is about reducing 1MDB to ‘scrap value’ so that they can pull off another MV Agusta scam where almost RM400 million was lost due to some funny business going on. In this new move, Malakoff will be able to pick up a RM51 billion asset for just RM9 billion and make an additional RM20 billion on listing 1MDB.

THE CORRIDORS OF POWER

Raja Petra Kamarudin

Before we talk about how Tun Dr Mahathir Mohamad had planned to use Malakoff to do a MV Agusta scam and transfer RM42 billion of government money into the pocket of his crony cum trustee (plus make an additional RM20 billion on listing those assets), let us first understand the last 25 years of the power generation or IPP business in Malaysia.

From 1979 to 1989, Samy Vellu was the Minister of Works. One of his major ‘achievements’ was to privatise the major toll highways in Malaysia to Umno cronies and companies at the behest of the then Prime Minister, Mahathir.

Lim Kit Siang went to court to try to obtain an injunction to block what he called daylight robbery but failed. The court kicked out Kit Siang’s application and the privatisation of Malaysia’s toll highways proceeded unhindered. Even the voters were not perturbed and gave Mahathir a resounding victory in the general elections.

In 1989, Samy was transferred to the Ministry of Energy, Telecommunications and Posts where he served as Minister until 1995, after which he was transferred back to the Ministry of Works where he served as Minister until 2008. While he was the Minister of Energy, Telecommunications and Posts, the government privatised power generation and created independent power producers or IPPs.

Samy was known as the Minister of Piratisation. After privatising (or piratising) all the toll highways, Mahathir sent him to the Ministry of Energy, Telecommunications and Posts to privatise power production. Then Mahathir transferred Samy back to the Ministry of Works to finish off his job of privatising water production.

After appointing Samy the Minister of Energy, Telecommunications and Posts in 1989, Mahathir appointed Ani Arope the new CEO of TNB in 1990, and in 1991 Anwar Ibrahim was appointed the new Finance Minister. Unknown to Malaysians, Ani Arope and Anwar were appointed the TNB CEO and Finance Minister respectively for a very specific purpose (which was to do a ‘reverse takeover’ of TNB by privatising the production or generation of electricity).

On 29th September 1992 (during Samy’s tenure as the Minister of Energy, Telecommunications and Posts, Ani Arope as TNB’s CEO, and Anwar as the Minister of Finance) Malaysia suffered a long and total nationwide power blackout, which the government said was caused by a lightning strike.

According to Ani Arope, however, the incident was actually planned and executed just to prove that Malaysia has no choice but to privatise the production of power to IPP companies due to TNB’s ‘incompetence’ and ‘incapability of managing the power business’.

A classmate of mine who was handling this matter told me that it was an act of sabotage, plain and simple, to justify privatising power production. In 1993, the first IPP was created in Paka, Terengganu, proving Ani Arope and my classmate correct.

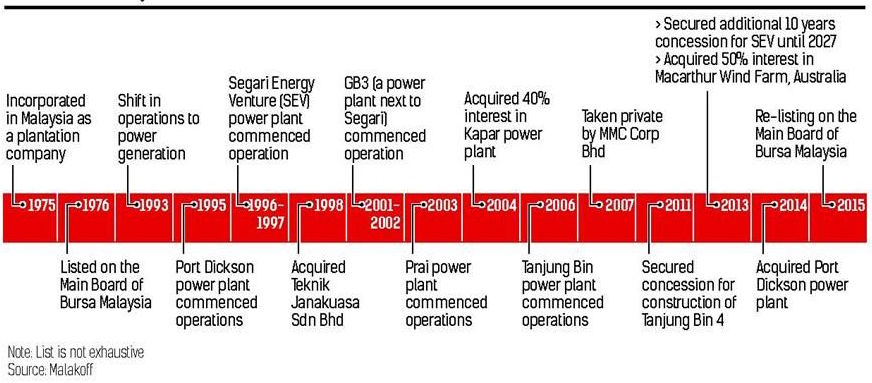

In that same year, 1993, as soon as the first IPP was created, Malakoff disposed of its plantation assets and shifted its activities to the power sector. Currently, Malakoff is the largest IPP in Malaysia and South-East Asia in terms of generation capacity. It has a sizeable portfolio of power generation assets in Malaysia, the MENA (Middle East and North Africa) region and Australia, according to Frost & Sullivan.

And Mahathir not only wants Malakoff to be the largest IPP that controls 50% of the power production, but he wants the company to practically monopolise the industry and thereby ‘own’ TNB through the backdoor or on a ‘reverse takeover’ basis.

Last year, analysts said Malakoff presented a good opportunity for investors looking to invest in an IPP. They said the uncertainty of 1Malaysia Development Bhd’s (1MDB) listing of its energy unit, Edra Global Energy Bhd, which had been postponed several times, also made Malakoff a stronger listing candidate compared to 1MDB.

In other words, since 1MDB is not able to proceed with its plans for an IPO, that makes Malakoff the numero uno of power production in Malaysia. Hence 1MDB’s sabotage or ‘failure’ is a huge advantage to whoever owns Malakoff. (You can read more about this below in the 21st March 2015 report by The Star: Malakoff set to make a comeback).

But the sabotage of 1MDB is not just about ensuring that Malakoff remains the top gun of power production. It is also to establish the benchmark for 1MDB’s value. Mahathir keeps saying that RM42 billion of 1MDB’s money has disappeared into thin air. This means 1MDB is another MV Agusta — meaning it is a company that has lost RM42 billion, is worth nothing, and should be sold off for a song.

Many of you may not know about what happened to MV Agusta and how RM400 million was flushed down the toilet. In December 2004, Proton bought a 57.75% stake in MV Agusta for 70 million euro (RM367.6 million). The then advisor of Proton was Mahathir.

They then announced that MV Agusta was a dying company. “In the event MV Agusta falls into bankruptcy, Proton would have been subjected to a contingent liability for an amount of up to RM923.1 million,” Proton said.

Not long after that, MV Agusta was sold for 1 euro (RM4.00), after which the person who bought it sold the company to Harley Davidson for US$109 million (RM450 million). So, Proton lost almost RM370 million and then ‘lost’ another RM450 million when it could have instead made RM80 million.

And this is what Mahathir plans to do with 1MDB. But he cannot do that unless Najib listens to him or Mahathir ousts Najib and replaces him. Mahathir wants the government to announce that 1MDB is in such a bad shape that it needs to be sold off for a song like they did with MV Agusta. And then Malakoff will play the role of ‘white knight’ and come in to help ‘save’ 1MDB.

That will allow Malakoff to monopolise the power production business and indirectly they would own TNB on a sort of ‘reverse takeover’ basis.

Just like in the water industry, distributing power is a messy business. The production of power is better, especially when you sell everything you produce in bulk to TNB on a guaranteed purchase and at a price that is fixed over a number of decades, which TNB has to pay whether they manage to sell that electricity or not.

Basically it is a money-printing business. TNB must buy all the electricity you produce at a certain price. Petronas, in turn, must sell gas to these IPPs at a lower than market price. The IPPs make money while TNB is lumbered with the messy job of retailing this electricity. Whether TNB makes or losses money is not the problem of the IPPs.

And that was why in 1996 Ani Arope resigned from TNB in disgust. He could no longer tolerate how TNB was being screwed to help the IPPs make money, up to RM20 billion a year according to Ani Arope. And what disgusted Ani Arope even more is that if he gave the IPPs any ‘problems’, within minutes he would receive a phone call from the Prime Minister’s office.

In short, Ani Arope did not want to become their stooge. So he left TNB. Today, their man in TNB is its CEO, Azman Mohd, who took over from another of their stooges, Che Khalib Mohamad Noh. So, since 1990, Mahathir and his cronies have had absolute control of TNB.

This was something that Mahathir had planned since 1989 when he transferred Samy Vellu to the Ministry of Energy, Telecommunications and Posts and he appointed Ani Arope the TNB CEO in 1990 and Anwar the Minister of Finance in 1991. Then, in 1992, they ‘arranged’ for a nationwide total power blackout and in 1993 awarded the first IPP concession.

Today, all the IPPs are in the hands of Mahathir’s trustees, proxies, nominees and cronies. And once 1MDB can be sold, the new owners of 1MDB will not only entirely control the power business in Malaysia, which means they also control TNB, but they will also make another RM42 billion on 1MDB considering that 1MDB is not negative RM42 billion, as Mahathir says, but has assets exceeding liabilities to the tune of RM9 billion.

So the plan is very simple. First they sabotage 1MDB’s IPO to bring the company to its knees. Then Mahathir announces that 1MDB has lost (rugi, as in trading loss) RM42 billion and that RM42 billion has disappeared into thin air — when in actual fact 1MDB merely has debts of RM42 billion but assets of RM9 billion in excess of debts.

Then, when 1MDB cannot be saved, Malakoff moves in and ‘saves’ it by buying it for just RM9 billion, which is RM51 billion assets minus the RM42 billion ‘loss’. Malakoff then can list 1MDB and make an additional RM20 billion on that listing on top of the RM42 billion it made on the undervalued 1MDB, giving Malakoff a gain of RM62 billion and a monopoly of the power generation industry.

Oh, and yes, Najib does know about this. And he also knows that this is the main reason why Mahathir has been attacking 1MDB since December 2014. It is not about ‘Saving Malaysia’, as Mahathir claims. It is about ripping off Malaysia and making billions, as what The Star report said below.

Najib knew that since 1990 Mahathir’s aim was to control the power industry, which would give the IPPs RM20 billion a year, according to Ani Arope. By the time Najib became Prime Minister the power industry was in the hands of Mahathir’s trustees, proxies, nominees and cronies and TNB was entirely under Mahathir’s control.

We have written about this earlier where we said:

Che Khalib bin Mohamad Noh has been a Group Managing Director of MMC Corporation Bhd since 1 July 2013.

Che Khalib served as the Group Managing Director of Malakoff Corporation Berhad (Malakoff) since 1 July 2013 until 8 December 2014 and served as the Chief Operating Officer of Finance Strategy and Planning at DRB-HICOM Berhad since 16 July 2012.

Che Khalib served as the Chief Executive Officer of Tenaga Nasional Berhad from 1 July 2004 to 30 June 2012 and served as its President until 30 June 2012.

Mahathir’s new battleground: TNB (http://www.malaysia-today.net/mahathirs-new-battleground-tnb/)

In April 2015, a certain Chinese businessman went to meet Leo Moggie, the TNB Chairman. This Chinaman made the mistake of mentioning Prime Minister Najib Tun Razak’s name — but not in a critical sense, though.

Leo Moggie quickly hushed that Chinaman and cautioned him about ‘using’ Najib’s name. ‘Najib’ is a ‘dirty word’ in TNB, explained Leo Moggie. Mahathir controls TNB and decides what happens. If you are seen as aligned to Najib then you are a dead man walking.

So nothing has changed in 26 years although Mahathir retired 13 years ago. TNB is still Mahathir’s domain and will remain his cash cow.

Mahathir’s unseen hands in TNB (http://www.malaysia-today.net/mahathirs-unseen-hands-in-tnb/)

Najib could not nationalise what had already been privatised. If the government wanted to take back control of what was regarded as a strategic and critical industry, which can be used to bring down the country if in the wrong hands, then the government would have to tackle it the commercial way by buying back the IPPs through a GLC.

And that was why 1MDB was created, to take back control of the power business and free TNB from Mahathir’s control. Realising that this is what Najib was planning, which if it succeeds would result in Mahathir losing control of the power industry, he sabotaged 1MDB — first by sabotaging the IPO and then by spreading the story that 1MDB has ‘lost’ RM42 billion when actually its assets exceed its liabilities by RM9 billion and the so-called RM42 billion loss was not a loss but borrowings.

And when Bank Negara blocked all loans to 1MDB that more or less ensured that the company was ready for Malakoff to take over.

Once this has all come to pass, which is what Mahathir is pushing for, Malakoff would be worth a great sum of money and it will all belong to Mahathir but in the name of his trustee, proxy, nominee and crony. The government will be made to take a haircut and absorb a loss of RM42 billion and that, together with the listing of 1MDB, will give Malakoff a profit of RM62 billion.

The sabotage of 1MDB’s IPO denied the government a profit of RM20 billion. If not 1MDB would have been worth more than RM70 billion with debts of only RM42 billion. And that IPO exercise would have given 1MDB the means to clear off all its debts and be worth far more than what it is worth now.

************************************************

Malakoff set to make a comeback

(The Star, 21 March 2015) – The country’s largest independent power producer (IPP) Malakoff Corp Bhd is back to delight investors, at least for some who have been waiting for its return. After all, Malakoff will likely be the largest initial public offering (IPO) in Malaysia this year.

Sources say Malakoff has priced its IPO slightly lower than its full value.

According to a circular to shareholders of MMC Corp Bhd, Malakoff’s parent company, the latter is being floated at an indicative price of RM1.80 per share, valuing the company at RM9 billion.

However, insiders say that if market conditions were better, the issuer might have been able to push for a higher value of close to RM10 billion.

“In light of market conditions and the performance of IPOs here and the region, the issuer has opted to leave something on the table for investors,” says a source.

Malakoff is offering a dividend payout ratio of at least 70% of profits and also has a growth story to attract investors.

Based on the indicative offer price, Malakoff should be raising some RM3.5bil from its IPO. Its prospectus will be issued in mid-April.

The indicative offer price of RM1.80 works out to financial year 2016 (FY16) enterprise value-to-earnings before interest, taxes, depreciation and amortisation (EV/EBITDA) of 8.5 times, based on an EV of about RM24bil for Malakoff, bankers say.

Affin Hwang Capital Research says the indicative IPO price of RM1.80 per share is similar to the research house’s own initial IPO price estimate of RM1.89, which in turn was based on Malakoff’s draft prospectus released earlier.

“At RM1.80, this translates to a 21.4 times 2015 estimated price-earnings (PE) premised on our forecast of 8.4 sen in 2015 earnings per share (2015 estimated net profit forecast is RM419mil while the enlarged share capital is estimated to be 5 billion shares),” Affin Hwang says in its report.

This suggests that Malakoff’s IPO valuation is an 84% premium to Tenaga Nasional Bhd’s (TNB) 11.6 times 2015 estimated PE, it adds.

In its report, Affin Hwang says unless its earnings estimate for Malakoff is too conservative, this suggests that MMC may be using gas-related companies such as Petronas Gas Bhd (23.6 times 2015 estimated PE) for valuation benchmarking instead of TNB.

One fund manager has put down a market value of RM10 billion for Malakoff, after taking into account the earnings from the soon-to-be commissioned Tanjung Bin 4 power plant in Johor.