Selangor MBI has no public accountability

A potential 1MDB like scandal waiting to happen

Murray Hunter

In the wake of prime minister Anwar Ibrahim’s launch of the National Anti-Corruption Plan, one of the major avenues where politicians and civil servants can manipulate assets and money is through special purpose vehicles formed under government.

According to the Chief Commissioner of the Malaysian Anti-Corruption Commission (MACC) Azam Baki, staggering losses of RM 277 billion has leaked out of government due to corruption over the last 5 years. This is a nearly 30 percent leakage of aggregate government budgetary spending over the last 5 years.

Part of the reason for this staggering corruption is the lack of transparency, and public accountability lies in thousands of government linked companies (GLCs), which have been set up over the years to handle public assets and undertake business ventures. There legal structures are opaque, often without auditing and transparent decision making.

One such vehicle is Selangor’s Menteri Besar Incorporated (MBI). MBI was enacted under the Enakmen MBI in 1992 by the Selangor State Assembly. MBI is not bound to any audit, and according to a Federal Court decision in 2021 (Faekah v MBI 2021), MBI is treated as a sole proprietorship, where the current Menteri Besar is the sole proprietor. MBI Selangor has assets and cash worth more than RM 32 billion outside of public purview.

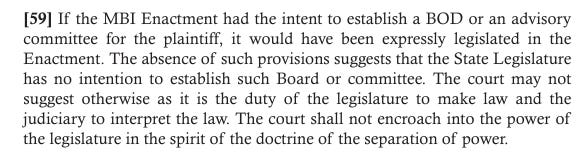

The effect of this, is such a framework without financial checks and balances allows the Menteri Besar to make decisions on public assets without any decision being able to be legally challenged. Consequently, this allows any sitting MB to manoeuvre assets and resources for his personal political agendas. There is no formal board of directors or advisory body set up in the original MBI Enactment. Faekah v MBI 2021 clearly stated this in the Federal Court decision:

Extract of Faekah v MBI Federal Court Decision.

Shah Alam Stadium

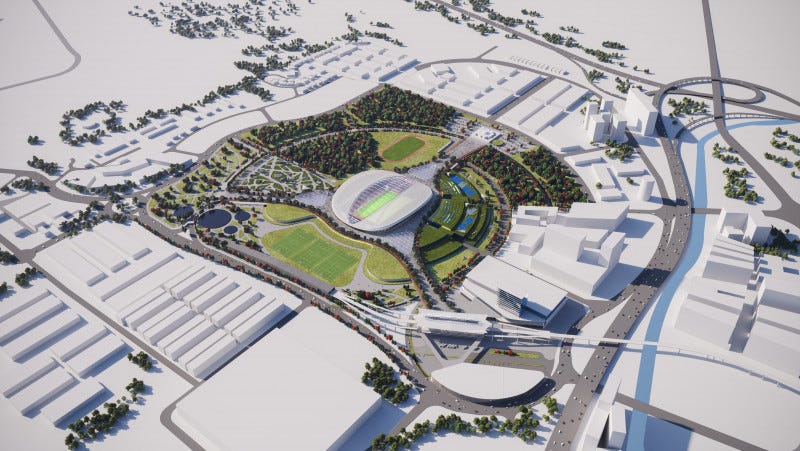

The announced plan to redevelop the Shah Alam Stadium complex into a commercial area with a much smaller stadium will cost Selangor citizens RM 3.28 billion. This is much larger than Selangor’s total aggregate spending of RM 2.54 billion in the 2024 budget. This brings up the issue about how MBI will be able to finance the Shah Alam Stadium redevelopment. Can Selangor afford this much without having to take a massive loan, or give over prime land packages, that are presently Selangor state land?

This is certainly a costly project for Selangor, where the decision has been made without any comprehensive business plan and financial analysis to determine the project’s return of investment (ROI) for the people of Selangor.

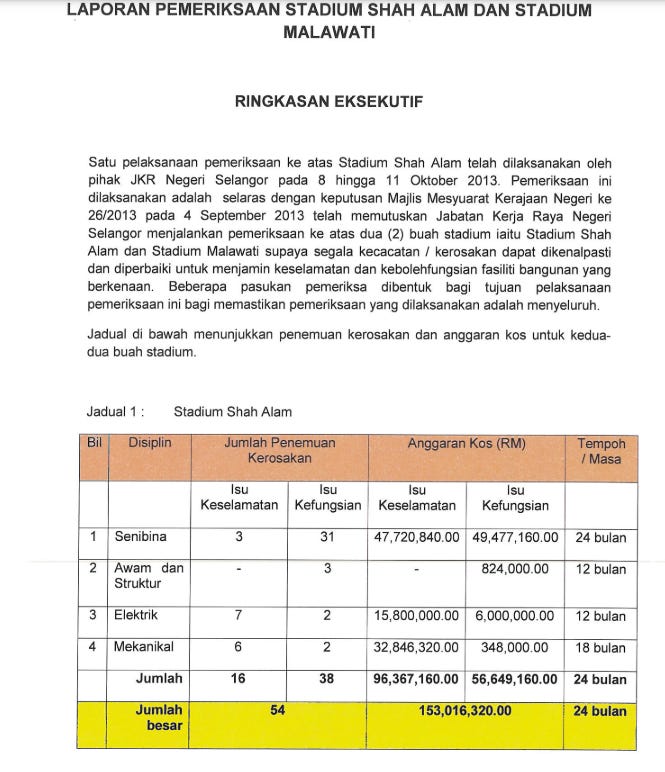

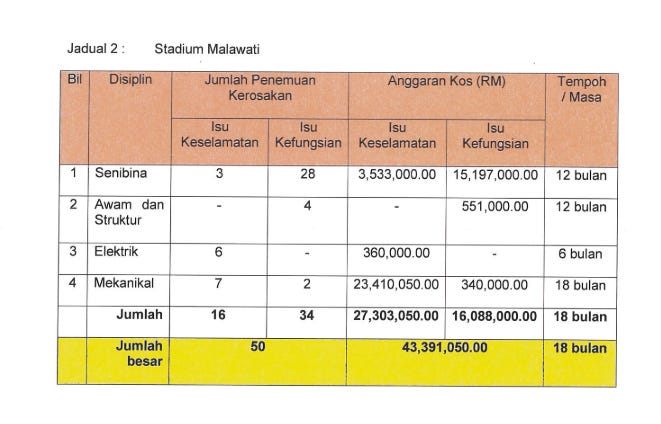

The second question is why MBI is spending RM 3.28 billion when the Shah Alam Stadium could be completely refurbished for less than RM 153 million, as per the JKR proposal (see below)?

RM 3.28 project plan

Thirdly, if there was an open tender called to demolish the stadium, the cost to MBI could be much less than RM 35 million agreed with the contractor.

All Malaysians should be concerned with the lack of transparency, and public accountability of MBI. Committing to a project that has a dubious ROI is a sign of gross mis-management, to say the least. The Shah Alam Stadium project should be a big red light, as it’s a massive loss of money just waiting to happen. This loss will unduly burden Selangor’s finances, where the people receive no benefit whatsoever.

What should have been learnt from the 1MDB case was that no one individual should be given sole discretionary power over funds and assets of the state. Selangor is running the risk of falling into this trap.

Azmin Ali promised when he was appointed the MB of Selangor to amend the MBI Enactment, so MBI would be answerable to the state assembly, where audited accounts are presented annually. This promise was never fulfilled, so absolute discretionary power of the MB with MBI remains today.

The current corporate structure of MBI Selangor allows mismanagement, asset and money laundering to occur without any outside scrutiny at all. Corruption will continue to thrive in such a legal environment.

JKR Proposal: