It is DAP and not Ismail Sabri who destroyed Malaysia’s economy

DAP has messed up the whole cash flow of the country, and this is the reason why the rakyat tengah susah and the rakyat menderita. And now, kononnya, it is Ismail Sabri’s fault.

NO HOLDS BARRED

Raja Petra Kamarudin

The picture being painted is that the rakyat tengah susah and the rakyat menderita because Ismail Sabri Yaakob is a perdana menteri yang lemah.

But that is not according to what economists have to say. The real problem is the country is short of revenue, hence there is not enough money for the government to help the rakyat.

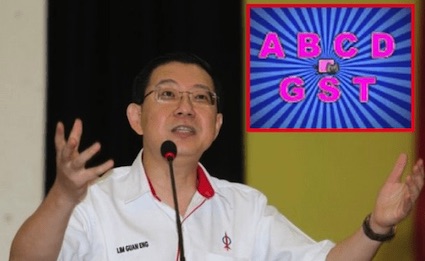

And the reason the government does not have enough money is because DAP abolished the GST when they came to power in May 2018.

DAP has messed up the whole cash flow of the country, and this is the reason why the rakyat tengah susah and the rakyat menderita. And now, kononnya, it is Ismail Sabri’s fault.

***********************************************************************

Reimplementing GST is best measure to revive the nation’s revenue: Economist

(Bernama) – The proposed reinstatement of the Goods and Services Tax (GST) is seen as the best government measure for reviving and increasing the nation’s revenue amid the country’s transition to the endemic phase starting April 1, according to an economist.

Universiti Teknologi Mara (UiTM) Perlis senior lecturer (economy) Associate Prof Azman Daim said the proposed reintroduction of the tax — a value-added tax where tax is collected at various stages of the supply chain — is to replace the Sales and Service Tax (SST).

“The benefits of implementing GST include enabling the government to generate a more stable revenue and it being more efficient. The tax should be implemented to help tackle the people’s economic problems and curb the excessive rise in prices for certain basic necessities,” he told Bernama here today.

However, he said the GST rate, which was previously set at six per cent, should be slightly lower so the people would not be “shocked” as many are still grappling with the effects of the Covid-19 crisis.

Prime Minister Datuk Seri Ismail Sabri Yaakob was reported as saying recently that the possible reinstatement of GST is seen as capable of widening the country’s revenue base, and that the government has not ruled out the possibility of reinstating it as an effective way to increase national income and help combat inflation and the rising cost of living.

He said the people need to understand and accept it first before the government decides to introduce any new taxation system.

GST was first introduced in Malaysia on April 1, 2015, at six per cent, but it was suspended on June 1, 2018, and finally abolished and replaced by SST on Sept 1, 2018.

The current rates for the sales tax are five per cent and 10 per cent, while the service tax is at six per cent.