Syed Zaid Albar: a wolf in sheep’s clothing

ABUSE OF POWER SCANDAL BY TOP MANAGEMENT AND OFFICERS OF THE SECURITIES COMMISSION – SO MUCH FOR THE INTEGRITY OF THE OUTGOING CHAIRMAN

NO HOLDS BARRED

Raja Petra Kamarudin

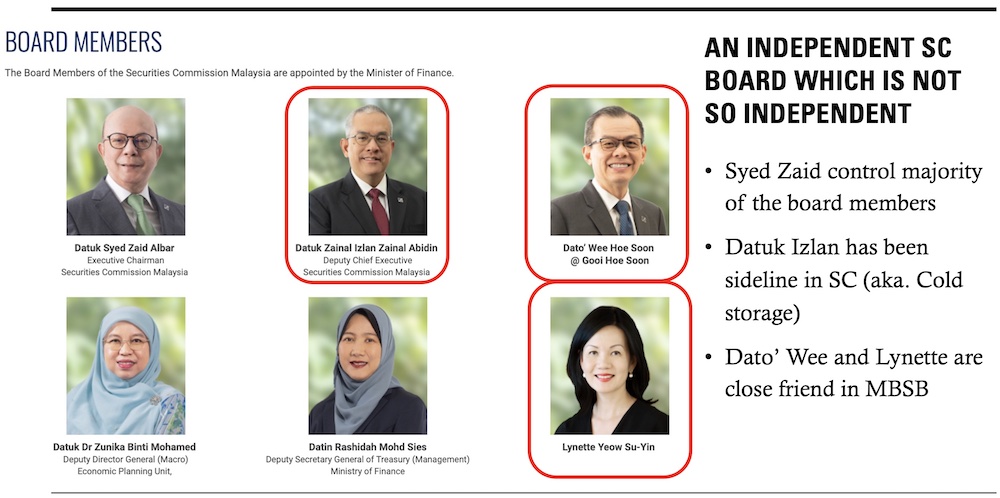

Much has been said about the issue of the resignation of the Securities Commission (SC) Chairman, Dato Syed Zaid Albar. Many question what was behind his sudden and unexpected resignation, just six months after his tenure was extended another three years. And this soon followed by other heads falling here and there.

Syed Zaid Albar tries to portray himself as a man of principles and integrity. In truth he is nothing but a wolf in sheep’s clothing. Suruh kambing jaga sireh, as the Malays would say. What many may not realise is that information received from reliable sources highlights a conspiracy and abuse of power involving Syed Zaid Albar, Roz Mawar Rozain, Foo Lee Mei and Leong Wei Leng.

The Albar family is large even by Arab standards. One brother courted the displeasure of then prime minister Tun Dr Mahathir Mohamad for selling Johor sand to Singapore, a treasonous act as far as Mahathir was concerned — because this allowed Singapore to extend its boundary far into Malaysian territorial waters.

Another brother was the defence minister during the time Mahathir was prime minister and Anwar Ibrahim the finance minister. This was when the Malaysian government made the decision to buy the Scorpene submarines from France. According to the then defence minister, this decision was based on recommendations from the technical committee of the ministry.

Their father, ‘the lion of Umno’, almost triggered a war between Malaysia and Singapore. So the Albar family is never too far from scandals and controversy.

The first clear case of abuse of power was on 28th November 2018 when an investigation was launched to probe Ace Holding Company on the instruction of Foo Lee Mei (Chief Regulatory Officer of the Securities Commission).

READ MORE HERE:

1. Revealed: Conflict of interest stares back at top SC officials

2. SC confirms three senior officials’ departures, announces replacements

3. SC executive chairman tenders resignation six months after three-year extension

On 24th January 2019, the SC raided Ace Holdings Company and after the raid, Ace Holdings Company’s lawyer revealed that SC officials had asked for money from the company.

On 28th November 2019, the investigation paper of this case was closed. Ironically, it was found that there were several SC staff working with Ace Holdings Company, which consisted of the case investigation team, namely Chang Min De, Lim Huey Hean Edward, Leong Wai Leng, Celine and Wong Zhen Fai, Kevin.

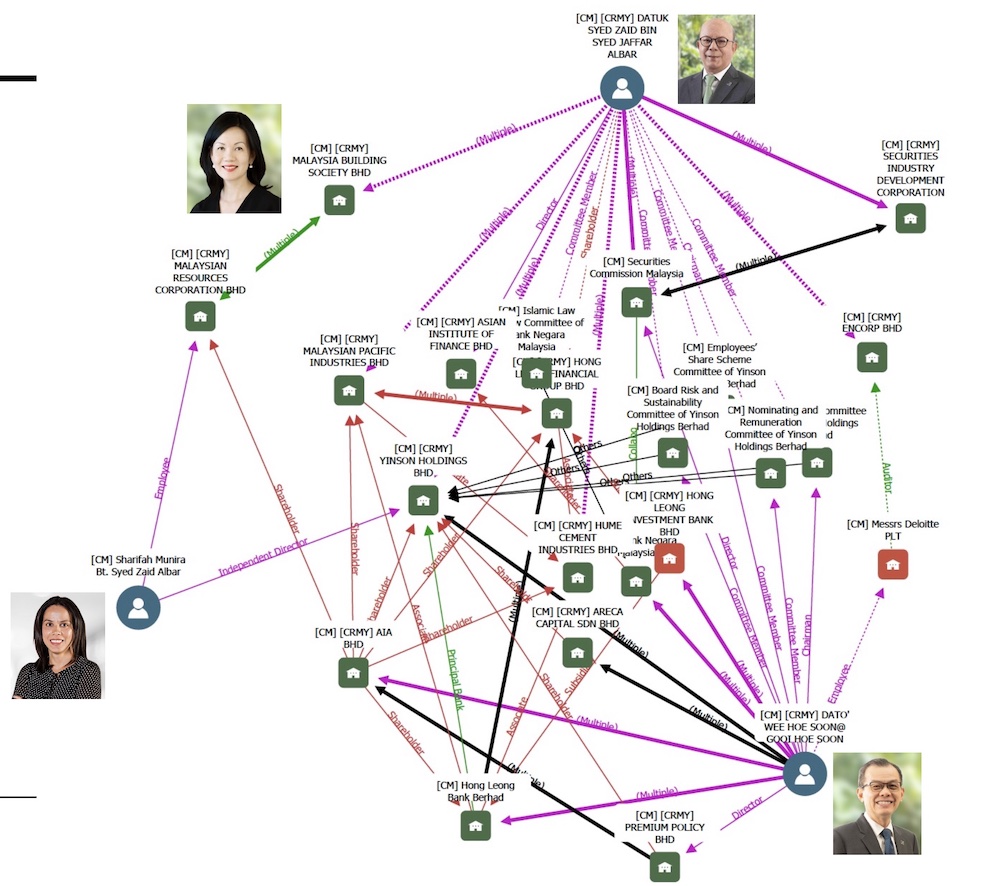

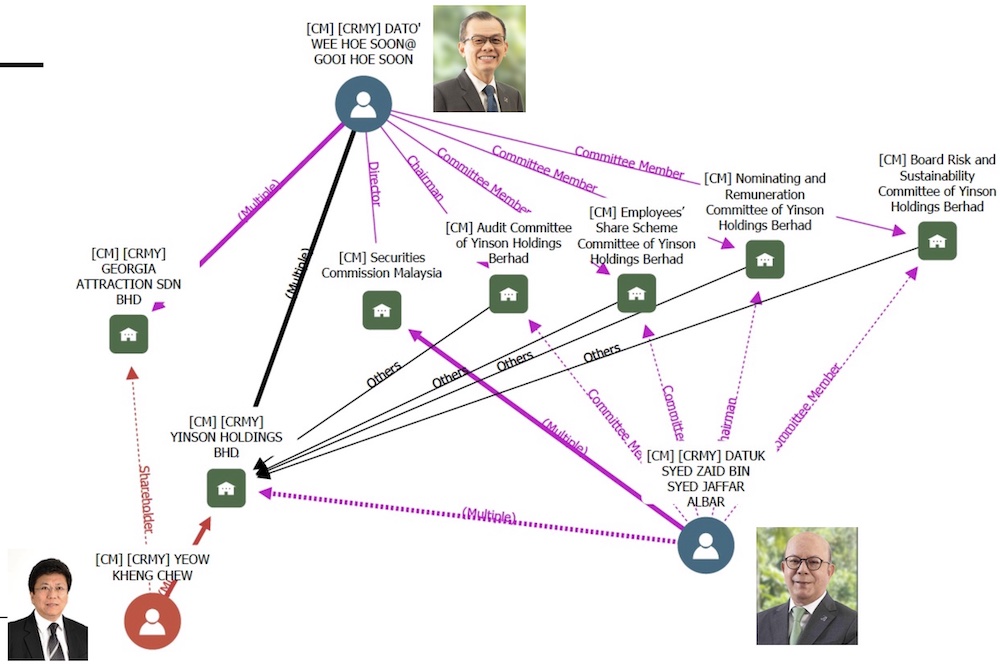

Information revealed in the Pandora Paper in relation to the issue of mutual relationship or conspiracy between Wee Hoe Soon@Gooi Hoe Soon (SC Board), Syed Zaid as well as Areca Capital (which acquired Yinson). As per Yinson’s announcement on 22nd May 2013 on the placement of 10% shares @10,017,755 @RM2.82/ share where Gooi Hoe Soon (Board SC) has been named as the holder. The shares are pledged with Areca Capital Sdn Bhd of which Gooi is the Chairman, Independent Director, and Member of the Independent Investment Committee. It was also noted that in 2001 Gooi was the Group Managing Director of Avenue Asset Berhad.

Avenue is the previous owner of ECM Libra stockbroking company, which was merged with Kenanga Investment Bank in 2012. Top dealer for most institutional DBTs, Patrick Taylor is also Head of Sales at ECM Libra.

Interestingly, Gooi and the owner of Kencana Capital (15% share placement) has a good relationship with Tan Sri Mokhzani Mahathir. Mokhzani was once the largest shareholder of Avenue Capital through his company Tongkah and Pantai Holding before he sold the stake in 2001. Gooi was the Managing Director of Avenue Group at the time.

An agreement for Areca Capital Sdn Bhd to be a client of the placement shares was made on 30th May 2013 whereby negotiations for the acquisition of FOP were supposed to be in the final stages and may have been notified to Areca and/or Gooi Hoe Soon.

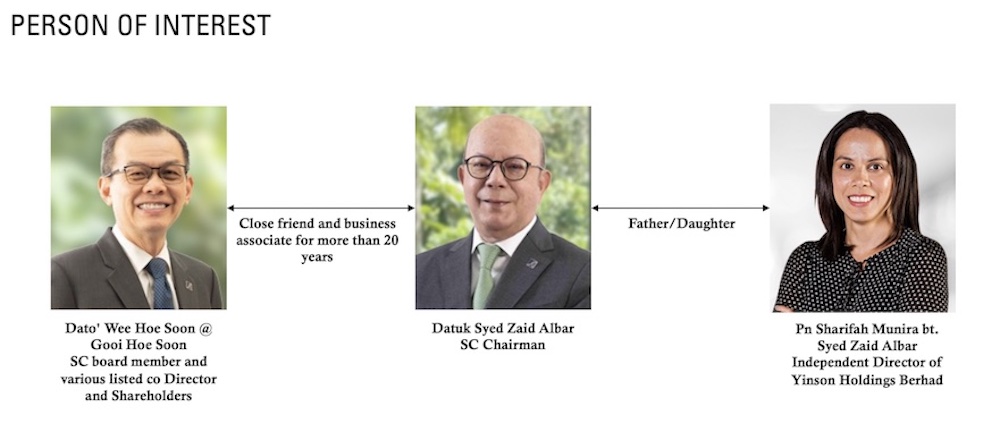

This situation is clearly an action of “conflict of interest” carried out by Gooi who is also on the SC Board. In addition, the former Chairman of the SC, Syed Zaid Albar, also benefited where his daughter Sharifah Munirah Bt Syed Zaid Albar was appointed as “Independent Non-Executive Director” starting January 1, 2020.

Datuk Syed Zaid Albar was a former board member in YINSON from 2016 to 2018 before being appointed as the Chairman of the SC in 2019. Sharifah Munira has been appointed as a member of the board of YINSON in 2020.

In 2021, YINSON raised and issued a Wakalah Sukuk worth RM1 billion. It was found that the sukuk issuance application by YINSON had elements of “conflict of interest” because Syed Zaid through Sharifah Munira still had an interest in YINSON at that material time.

Thirdly, there is also an investigation into “Insider Trading” involving YINSON shares where the investigation probed the offense of “insider trading” by several individuals/entities that have been identified as being active in the sale/purchase of YINSON shares.

Among the individuals who have been identified throughout the investigation process are Lim Han Weng (Chairman of YINSON), Lim Chern Yuan (CEO of YINSON), Herman Ng (Friend of Lim Han Weng) and Dato ‘Wee Hoe Soon @ Gooi Hoe Soon (GHS).

The SCs’ Investigating officer came up with a convenient ‘No Further Action’ decision on GHS in 2014 on the premise that the investigation into it found no ‘misuse’ of inside information used to make a profit.

This scandal is just the tip of the iceberg. Today’s revelation is just one of many more to come. The SC was run like a cartel and more dirt will be revealed soon. So stay tuned as we reveal how the SC stinks to high heavens.