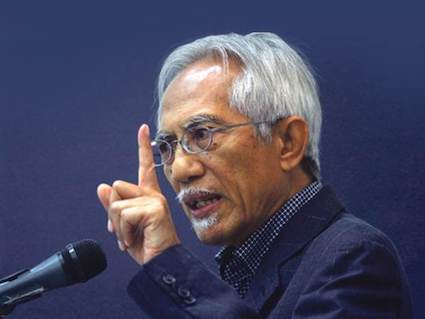

Kadir Jasin against EPF withdrawals

(Malaysiakini) – Umno’s populist push to allow large sums of money to be withdrawn from the Employees Provident Fund (EPF) may ultimately come back to bite contributors, according to veteran newsman A Kadir Jasin.

“If the EPF contributors are allowed to withdraw their savings at will, as suggested by these popularity seekers, the pension fund will have to sell billions upon billions of investments to raise cash to pay them.

“This will depress share prices and may even force it to sell its assets at a loss.

“In time, it may not even have enough capital to generate meaningful returns to the remaining contributors. This was how many such funds around the world went bankrupt,” he said in a Facebook post.

Kadir noted that Umno’s push is getting popular support, even though this can be detrimental in the long-term.

“Sadly because many Malaysians are uninformed or are just too lazy to think, these liars and hypocrites have a field day misleading them,” he said.

Kadir added that Umno leaders have, in the past, also made decisions that were to EPF’s detriment.

For example, he said, under the era of former prime minister Abdullah Ahmad Badawi, the EPF was made to provide an RM25.29 billion loan to the Finance Ministry-owned Pembinaan PFI Berhad.

“How do we expect EPF contributors to benefit from the massive loan to PFI when it is paid only 0.5 percent interest?

“Furthermore, the loan tenure had since been extended from five to 15 years – expiring in 2027 – according to a report to the Parliament,” he said.

Kadir also pointed out that Abdullah’s successor Najib Abdul Razak left the country with more than RM50 billion in debt from the scandal-plagued 1MDB, which became the subject of an international money-laundering case.

Part of the misappropriated money included RM3.95 billion in loans by the Retirement Fund Incorporated (KWAP) to SRC International Sdn Bhd, a former 1MDB subsidiary.

Last year, EPF only issued a 5.45 percent dividend, the lowest since the 2008 financial crisis.

Kadir said the historic low dividend of only five percent for Amanah Saham Bumiputera (ASB) contributors announced last week may not be a good sign for EPF’s own dividend for 2020, which will be announced in February next year.

He said this was, in part, due to the fact that many of the government funds are invested in the banking sector and rely on their profits to pay out good dividends.

The PN government imposed a moratorium on the repayment of bank loans from April to September to help people cope with the Covid-19 pandemic, but it was later extended for several categories of people following pressure from Umno.

“While it may be true that banks can withstand losses due to the moratorium, but investors who hold their stocks and shares will suffer instead. Prices of banking stocks had tumbled since the enforcement of the moratorium.

“Banks are some of the biggest and most profitable counters on Bursa Malaysia and large government-linked investment companies (GLICs) are among their key investors.

“Losses by the banks in both profitability and market capitalisation will have a negative impact on the profitability of GLICs such as EPF, Perbadanan Nasional Berhad, Khazanah, KWAP, Tabung Haji and the Armed Forces Fund Board (LTAT),” he said.

Kadir stressed that people should not harm EPF when they are reliant on the fund to build retirement savings.

“Don’t kill the goose that lays the golden eggs,” he said.