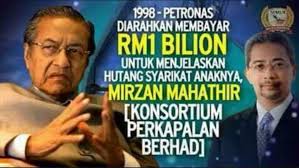

Is Mahathir Holier Than Najib?

Is Latheefah Koya, newly appointed MACC Chief handpicked by Mahathir personally, capable and willing to investigate this billion ringgit bail-out?

Zaedi Zolkafli

In March 1998, Malaysia International Shipping Corp. (MISC) announced that it would buy the assets of Mirzan Mahathir’s shipping company, Konsortium Perkapalan Bhd (KPB). Malaysia’s national petroleum company (PETRONAS) would increase its shares in MISC via share swapped deal nearly RM 6 billion to enable the latter buy over KPB and its Hong Kong-based company Pacific Basin Bulk Shipping Ltd.

“MISC will hand over a total of USD 220 million to Mr. Mirzan” plus “take over net debt of USD 311 million from the acquired companies”. Based on current FOREX, an amount of RM 2.18 billion was used to buy out Mirzan’s interest in the debt ridden shipping company. “Mr. Mirzan revealed that the sale would reduce his company’s debt to almost zero”.

Prime Minister Mahathir was at the time PETRONAS advisor. This “politically motivated rescue” using state funds was objected by his then deputy Anwar Ibrahim who was Finance Minister that led to the latter’s sacking from Government by the time the deal was wrapped followed by his false imprisonment, while Mahathir himself took charge of the Finance Ministry. Was Hassan Merican (then PETRONAS CEO cum MISC Chairman) acting on orders from his Boss?

Is Latheefah Koya, newly appointed MACC Chief handpicked by Mahathir personally, capable and willing to investigate this billion ringgit bail-out?

STORY SOURCE

Wall Street Journal Report

MISC to Pay $220 Million (RM900m) Million Price For Assets From Mahathir’s Son

By : Chen May Yee Staff Reporter of The Wall Street Journal

Updated May 1, 1998

KUALA LUMPUR, Malaysia — Easing fears of an expensive, politically motivated rescue, a state-controlled shipper said it would pay $220 million for assets from Prime Minister Mahathir Mohamad’s eldest son, a price many analysts called fair.

When Malaysia International Shipping Corp., or MISC, in March said it would buy the shipping assets of Mirzan Mahathir’s company, Konsortium Perkapalan Bhd., whose primary activity is providing container-haulage services, it provoked accusations of a bailout, especially since Mr. Mirzan revealed that the sale would reduce his company’s debt to almost zero. Many analysts viewed the deal as another example of the rescues that have put in doubt Malaysia’s commitment to face its economic troubles, mainly by using state funds to help sickly private companies.

These analysts came away happier Thursday. “Yes, [MISC is] helping out Mirzan, but they are not paying a hefty price for it,” said Alan Inn, an analyst with Caspian Securities. “MISC got away quite nicely,” he added.

“The entire exercise will make MISC a stronger organization,” said MISC’s chairman, Tan Sri Hassan Marican, who is also president of state oil company Petroliam Nasional Bhd., or Petronas.

“Overall,” he added, “it is a fair deal for everyone.”

The entire deal comes in several parts. MISC will buy the entire share capital of Petronas Tankers Sdn. Bhd. from Petronas by issuing 859.91 million new MISC ordinary shares of one ringgit (26.8 U.S. cents) each at 6.96 ringgit per share to Petronas. This will result in Petronas owning 62.01% of MISC, from 29.34% currently.

MISC will also buy Hong Kong-based PNSL Ltd., formerly known as Pacific Basin Bulk Shipping Ltd., from Konsortium Perkapalan, or KPB, for US$55 million. Analysts described the price as low but fair considering the expected hit the company’s business will take from the Asian economic turmoil in the next few years. Mr. Mirzan had bought Pacific Basin in 1996 for US$230 million.

In addition, MISC will buy the assets of KPB’s Malaysia-based PNSL Bhd. for US$165 million. Mr. Mirzan purchased PNSL Bhd. for 247.4 million ringgit from a state agency in 1992. The higher price MISC is paying partly stems from the charters and therefore fixed revenues these assets come with.

That means MISC will hand over a total of $220 million to Mr. Mirzan. That figure is just below the range of $224 million to $313 million at which the assets were valued by an independent appraiser appointed by MISC’s bankers. That valuation assumed that MISC would also take over net debt of $311 million from the acquired companies.

Tan Sri Hassan said the parties expect to wrap up the deal by the end of August, subject to regulatory approval. MISC will pay for the deal partly from internal funds and partly from borrowings, he added.