Report: Investors not impressed with PH’s economic policies

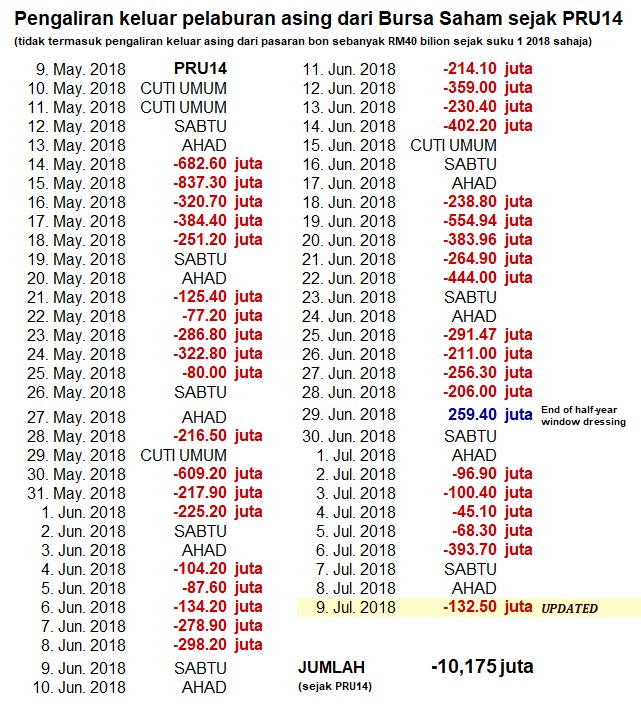

(FMT) – The government of Dr Mahathir Mohamad has offered little of substance in terms of new economic policies, which has encouraged capital outflow, according to a report.

The Nikkei Asian Review (NAR) said this and some of the government’s policies – including the removal of the goods and services tax (GST) – had contributed to the ringgit losing against the US dollar and a further dip in the share market.

The NAR report said two months after Pakatan Harapan won power, capital was flowing out of the country because investors were not convinced that Mahathir would be able to chart a viable growth path.

It noted that the ringgit was stable immediately after Mahathir took office in May, as he had promised a greater focus on markets, but that it had since softened beyond 4 to the US dollar.

This is due to mounting concern over the country’s finances. NAR said the revelation that government debt was at more than RM1 trillion, far higher than previously thought, had added fuel to the fire.

The benchmark FTSE Bursa Malaysia Kuala Lumpur Composite Index, which held firm early in the year, dropped after Mahathir took the reins and has since fallen nearly 10%.

The Ringgit is falling against most currencies

The report said although escalating trade tensions between the US and China had weighed on Asian stocks more broadly, “the new government’s policies hastened the decline in Malaysia”.

Among these, it said, were the scrapping of the GST and the reassessment of major infrastructure projects decided upon by the Najib Razak government. Infrastructure-related stocks such as YTL have taken a beating.

The report said the government had offered little of substance in terms of new economic policies but that Mahathir had, instead, revived policies from his previous stint as prime minister from 1981 to 2003.

This includes possibly establishing a new national automaker and a renewed Look East Policy.

NAR reported that with the global auto industry changing at a dizzying pace, any new venture would face unclear prospects of success, noting that Mahathir’s brainchild Proton Holdings was “hardly a runaway success, posting sluggish sales in recent years”.