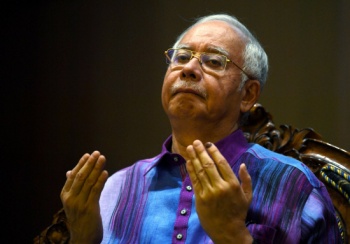

Najib being probed for possible income tax violations

(Bernama) – The Inland Revenue Board (IRB) says the RM2.6 billion received by former Prime Minister Datuk Seri Najib Tun Razak is now subject to further examination.

Its chief executive officer, Datuk Seri Sabin Samitah, said that in light of the disclosure by current Malaysian Anti-Corruption Commission (MACC) chief, Datuk Seri Shukri Abdull, and ongoing investigations on all issues related to 1Malaysia Development Bhd (1MDB), the taxation for the said RM2.6 billion will now be subject to further examination

On Feb 16, 2016, the agencies investigating the RM2.6 billion had found that it was a voluntary “donation”, and thus not subject to income tax, he said.

However, Sabin explained that even such a voluntary payment may change in character and be subject to tax.

This can happen if, “it is given repetitiously, as consideration for services rendered, in return for any benefit of any kind, or if the amount is used in a business activity to sustain business operations,” he said in a statement on Thursday (June 7).

He made these comments after recent developments on the RM2.6 billion, as well as cash and other valuables recently seized from Najib-linked residences.

Sabin said to ascertain the true nature of the RM2.6bil, the IRB would work closely with all agencies and the newly formed task forces involved in 1MDB investigations.

With regard to the seizure of cash and valuables, Sabin said a notice under section 78 and 79 of the Income Tax Act 1967 will be issued by the Director-General of Inland Revenue to individuals connected to the items seized.

He said the purpose of the notice was to ascertain whether sufficient disclosure of income had been made to the IRB commensurate with the assets (cash and valuables) owned by a particular individual.

In the event of unexplained wealth, additional tax will be raised. There is also penalty up to double the amount of tax under-declared.

“Failure by a person to comply with the notice within the specified time is an offence and can be prosecuted under the Income Tax Act 1967,” he said.