Uber and Travis Kalanick are in business again

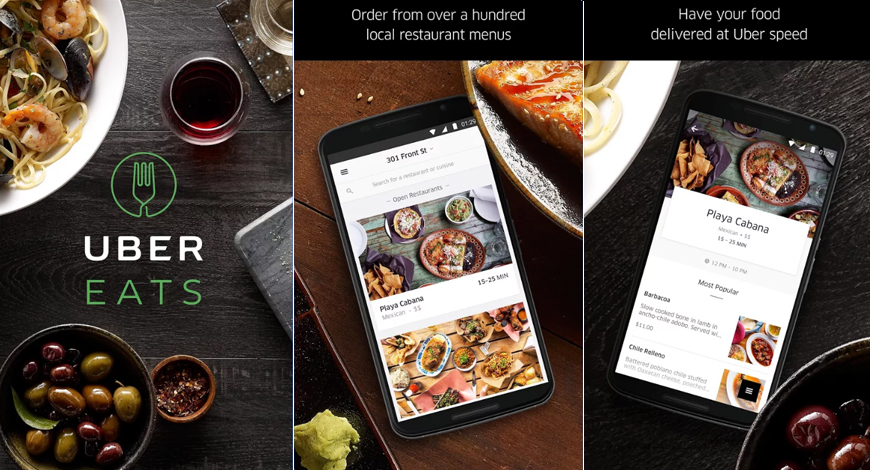

(Bloomberg) – Uber Technologies Inc is already delivering billions of dollars’ worth of food for local restaurants. Soon it could be taking over their kitchens, too.

The ride-hailing giant is testing a programme where it rents out fully equipped, commercial-grade kitchens to serve businesses selling food on delivery apps like Uber Eats.

Last year, Uber’s food delivery team began quietly leasing real estate in Paris, according to a person familiar with the project. It has been stocking the space with ovens, refrigerators, sinks, stoves and other appliances, and renting them out to restaurateurs planning eateries that cater exclusively to delivery customers, said the person, who asked not to be identified because the pilot program hasn’t been disclosed publicly.

While the “virtual restaurants” programme is early, the undertaking would put Uber in direct competition with a business owned by its polarising co-founder and board member, Travis Kalanick. The former Uber chief executive officer, who was ousted after a series of scandals, has largely tried to keep his second act under wraps. He hasn’t granted interviews to reporters since taking over a real-estate company, City Storage Systems. But as his startup expands its main business of renting kitchen space, it’s becoming harder to hide.

The existence of Uber’s virtual restaurant project, the confrontation with Kalanick and many of the details around his new venture haven’t been previously reported. An Uber spokesman declined to answer questions about the pilot programme but played down the conflict with Kalanick.

“It’s been encouraging to see all the innovation happening in the food space-particularly how commercial kitchens have made it easier for restaurants to get started,” the spokesman wrote in an email. “The more restaurants there are, the more selection Uber Eats customers can enjoy, and we believe that the growth of CloudKitchens and others like it will be great for both the food industry and for consumers.”

A spokesman for City Storage Systems, also known as CSS, said Uber was instrumental in helping get its kitchen-rental business off the ground and that more than 90% of tenants offer their fare through Uber Eats. “CSS is proud to develop real estate for the food industry at large, and Uber is an important partner in that effort,” the spokesman said.

Kalanick led Uber for seven years, transforming it from a startup directing a small fleet of black cars in its hometown of San Francisco to a global transportation network connecting millions of people with drivers and dinners on demand. But Kalanick made a series of disastrous errors, which included spearheading a deal that led to a trade-secrets lawsuit, overseeing an office culture defined by its HR violations and engaging in a heated argument on camera with a long-time Uber driver. Kalanick made his financiers very rich by building Uber into a business valued at about US$70bil (RM286.18bil), but some of those investors forced his resignation as CEO in 2017 after the protracted period of turmoil.

It didn’t take him long to stage a comeback. Less than a year later, Kalanick purchased a controlling stake in City Storage Systems for US$150mil (RM613.24mil). The company buys buildings or plots of land, making a bet that the gig economy will forever alter the value of real estate in major cities.

Kalanick particularly embraced one business idea, for so-called smart kitchens. It would allow people to open pseudo-restaurants when they couldn’t otherwise afford a location of their own or where doing so would be impractical. After Kalanick unveiled the effort, Uber CEO Dara Khosrowshahi praised it on Twitter as a “super-interesting partner of Uber Eats today”.

CloudKitchens is now working with various restaurants and food brands in Los Angeles, including the fast-casual chain Sweetgreen and Canter’s Deli. Humphry Slocombe, a popular California ice cream shop, has also been leasing space in Los Angeles from CloudKitchens. Customers can order flavours like Secret Breakfast (bourbon ice cream with cornflakes) or Matchadoodle (snickerdoodle cookies with Japanese green tea) through Uber Eats or one of its many competitors, Caviar, Grubhub or Postmates. Humphry Slocombe only has one store in Los Angeles, but CloudKitchens enables the brand to reach customers in a much wider area.

Once a week, Humphry Slocombe workers drop off pints of ice cream, and CloudKitchens does most of the rest. It stocks products in freezers, monitors orders from delivery apps, bags the ice cream and hands each package off to couriers. CloudKitchens provides Humphry Slocombe an app for the restaurant to track sales and takes a cut from each order, on top of a monthly fee for the space, said Claire Koerschen, the wholesale and e-commerce manager for the San Francisco-based ice cream chain. “It’s easier to get that reach without having to create a new location,” she said. “It does really well for us, and there’s not much effort that’s put into it.”

CloudKitchens has taken off in Los Angeles and is aiming for rapid expansion. It has plans to operate in San Francisco and Chicago soon. And the South China Morning Post reported last month on City Storage Systems’ intention to open in China, where homegrown alternatives have already sprung up. Similar kitchen-rental businesses exist in London, Paris and beyond. Kalanick recently went on a world tour where he met with many former Uber employees. Some decided to join their old boss.

Unlike Uber, which benefited from a steady drumbeat of news coverage to help attract customers, Kalanick has taken a far more secretive approach with his new startup. Employees are asked to keep City Storage Systems off their LinkedIn profiles, people familiar with the requests said. Several former Uber employees now living in Los Angeles list their current employer as “a stealth startup”, a “real estate startup” or simply “x”.

It’s unclear how many Uber veterans Kalanick hired, but it was enough for his old company to put him on notice last year. Uber’s virtual restaurant project is nascent, but food delivery has become an important business. Gross bookings for Uber Eats represented 17% of the company’s total in the third quarter. (Uber didn’t disclose the number the following quarter.) Uber’s CEO plans to make it a core part of his IPO pitch to investors.

The early success of CloudKitchens has demonstrated the promise of the model. That leaves Uber with a dilemma: Should it invest in its own virtual restaurants on a worldwide scale or partner with a company like CloudKitchens and avoid another conflict with its co-founder? There’s a good argument to partner. Uber could avoid the risks associated with buying or leasing real estate and focus on using its drivers to deliver meals.

There’s even a scenario where Uber’s kitchen-rental service and Kalanick’s can coexist. Other Uber insiders have conflicting interests. SoftBank Group Corp, the largest Uber shareholder, is a major backer of a competing food delivery business, DoorDash Inc.

But it’s also possible Kalanick’s position with the company could become a subject of contention. Uber has privately discussed plans to shake up its board after going public, a person familiar with the deliberations said. Unlike Lyft Inc, the US ride-hailing rival that’s giving founders outsized voting rights as part of its IPO, Uber will be ruled by common shareholders, who will have power to reshape the board. Directors like Kalanick have seats contractually assigned to them while the company remains private, but those agreements dissolve once it’s public.