The untold story of Guan Eng’s proxy, the Penang Condo King

All told, these housing projects, undersea tunnel and reclamation projects come to more than RM60 billion. And Guan Eng-DAP are using proxies to implement these projects. And amongst these proxies who Guan Eng-DAP are using is the famous “Condo King”, Alex Ooi.

NO HOLDS BARRED

Raja Petra Kamarudin

This is what was reported by Property Insight in October 2019:

Penang Island has been receiving a lot of interest when it comes to property market. As the saying goes, nothing can go wrong if you invest in a property on an island. But how is it really doing in this current market? Property Insight talks to the Executive Chairman of Ideal Property Group, Dato’ Alex Ooi, to find out.

Ooi started the group on his own in 2002 from scratch and managed to steer the company into developing more than 10,000 units of residential and commercial units locally as well as abroad. In the early years, he even managed to successfully develop several residential and commercial developments in Cambodia.

Ooi now focuses on developing projects locally, which comprises more than 50% of the housing supply on Penang Island. His developments, which concentrates mainly within the vicinity of Bayan Lepas, have made a positive change in the skyline of Penang South West District. With his vast experience, he managed to turn the group into a major market player in Penang with a successful track record that earned him the nickname the ‘Penang Condo King’.

(READ MORE HERE).

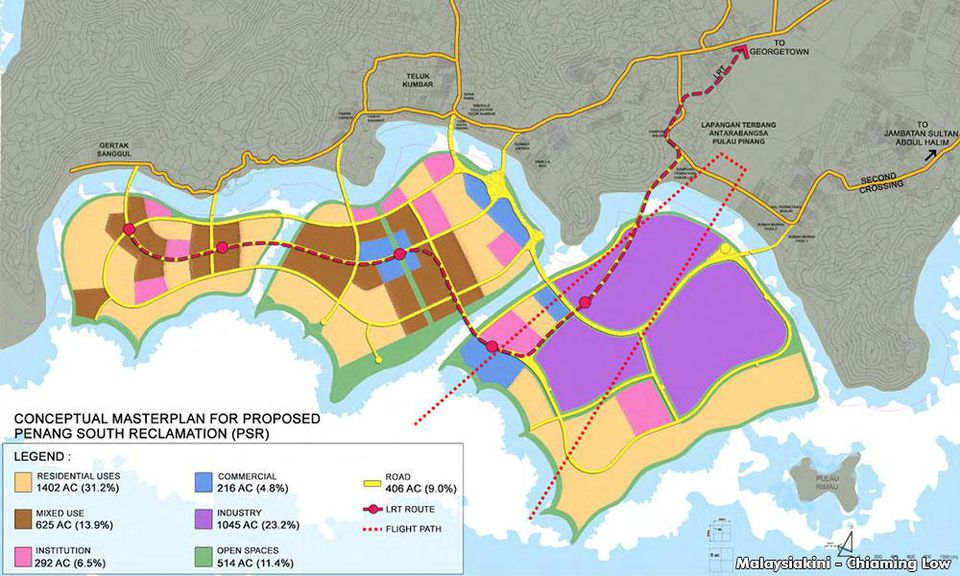

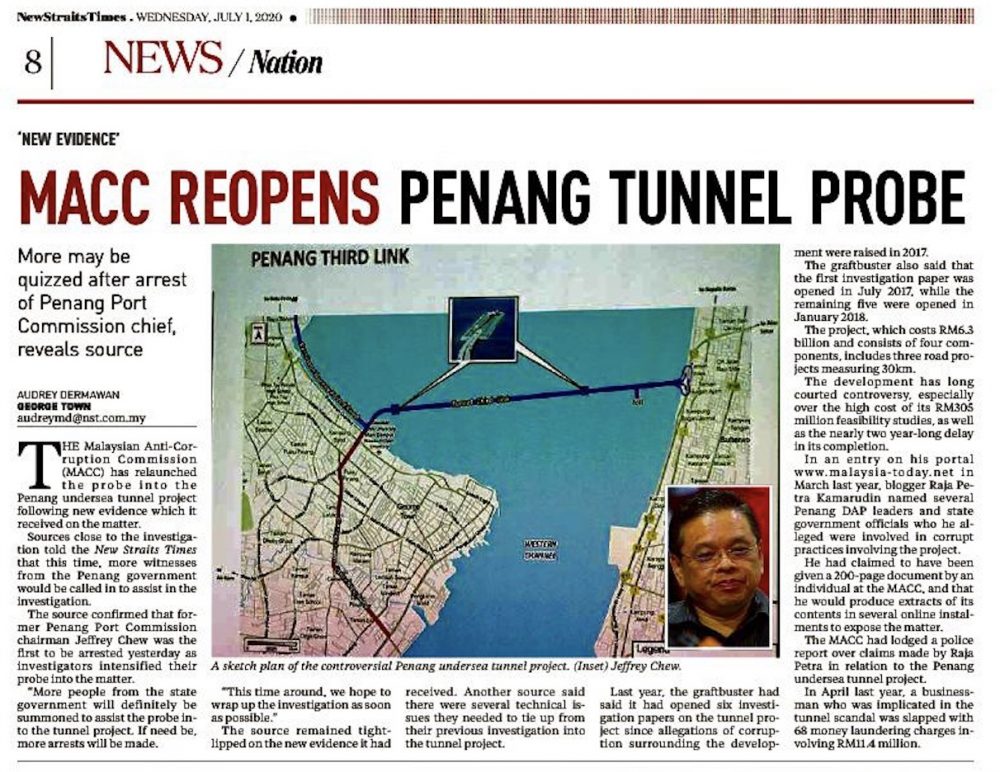

Lim Guan Eng and DAP are not only involved in the RM6.3 billion Penang undersea tunnel project and the multi-billion reclamation project to create three new islands in the south of Penang, they also have their hands in the pie of about 50% of the property development on Penang island.

All told, these housing projects, undersea tunnel and reclamation projects come to more than RM60 billion. And Guan Eng-DAP are using proxies to implement these projects. And amongst these proxies who Guan Eng-DAP are using is the famous “Condo King”, Alex Ooi.

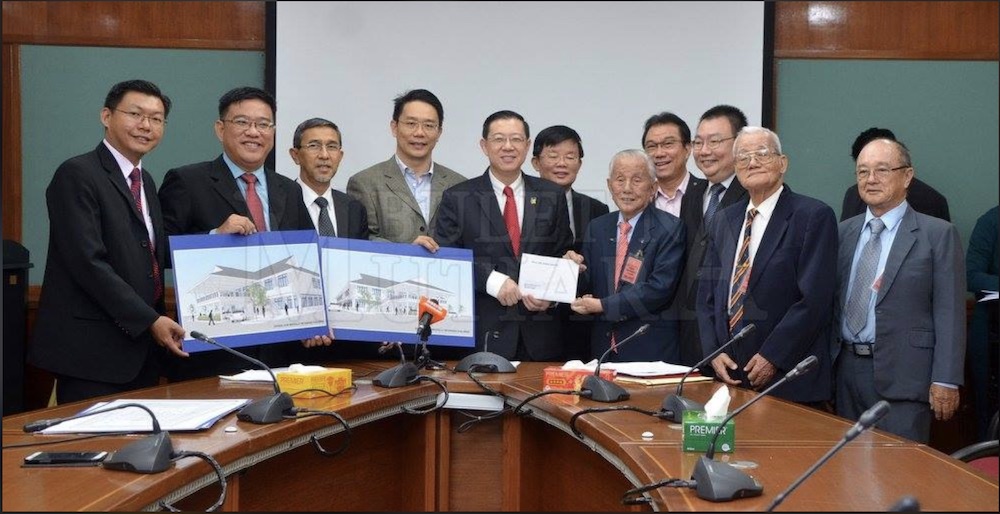

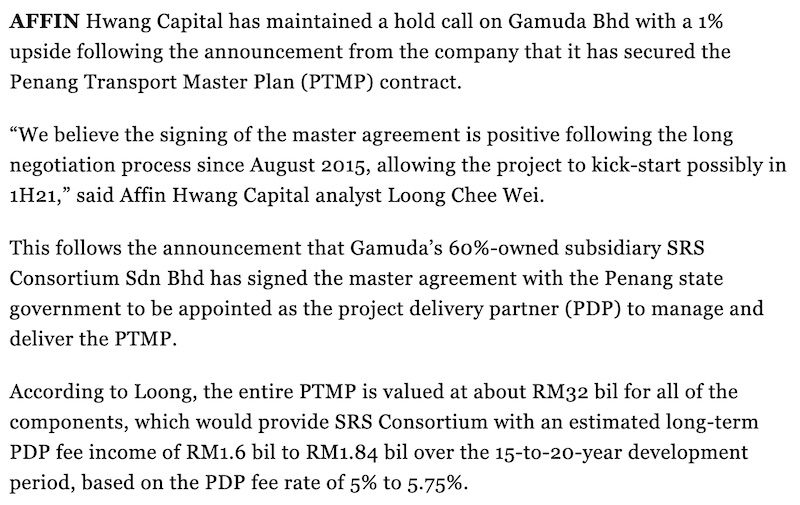

Alex Ooi and Lim Kean Seng own 40% of the estimated RM40 billion housing projects in Penang with Gamuda owning the balance 60%. Gamuda is also known as another DAP financier, which is a fact they do not try to hide. In fact, Gamuda is said to be financing both sides of the political divide.

Guan Eng had earlier agreed for the government to buy over Gamuda’s toll concessions at a generous price, which would have made them extremely cash-rich (READ MORE HERE: Putrajaya offers to buy four toll concessionaires for RM4.5b cash). But the Pakatan Harapan government fell before Guan Eng could complete the deal (READ MORE HERE: Gamuda’s sale of highways to government may have fallen through).

Yesterday, 35 officers from the MACC and 15 officers from the LHDN raided Alex Ooi’s office (READ MORE HERE: MACC raids companies as probe onto Penang tunnel project resumes). This has frightened Guan Eng and DAP who feel they are about to take a fall (READ MORE HERE: DAP questions revival of corruption probe into undersea tunnel).

The MACC and the LHDN have finally caught up with Guan Eng and his gang of robbers

They also froze Alex Ooi’s bank accounts under AMLA. If a snap general election is called soon, DAP would be hard-pressed for money because their financiers are facing many legal issues. The worst is yet to come as the MACC and the LHDN dig up more dirt involving Guan Eng, DAP and the many proxies they are using to raise billions in political funding through what Tun Dr Mahathir Mohamad calls “offset”.

The Penang undersea tunnel scandal is going to hurt many people in DAP as well as Umno because names such as Mohamed Nazri Abdul Aziz and Abdul Rahman Dahlan have been mentioned in the MACC report. Consortium Zenith Construction Sdn Bhd’s director, Zarul Ahmad Mohd Zulkifl, is being made the fall guy in this whole scandal, as it is normal for DAP to use Malays as fronts and then hide behind them when the shit hits the fan.

Jeffrey Chew is the bagman for Guan Eng and the person who collected the bribes on behalf of Guan Eng

**********************************************************************************

‘Penang Condo King’ enlarges stake in Tatt Giap

(The Edge, 5 Feb 2018) — Tan Sri Alex Ooi Kee Liang — whose flagship Ideal Property Group’s numerous condominium developments across Penang Island have earned him the moniker “Penang Condo King” — has emerged as a substantial stakeholder in ailing steel products manufacturer Tatt Giap Group Bhd, in what may be a prelude to his foray into the state’s mainland property market.

According to The Edge weekly, the 46-year-old had amassed 21.4 million shares representing a 12.54% stake, with an acquisition of 13 million shares from Giapxin Sdn Bhd, the private vehicle of Tatt Giap chairman Datuk Steven Siah Kok Poay and his brother Siah Lee Beng.

As at Jan 17, Giapxin is no longer a substantial shareholder of Tatt Giap while Ooi is now the second-largest shareholder, after Hong Kong-based Arich Holdings Inc, which owns a 13.89% stake. It is unclear who controls Arich.

Gamuda’s subsidiary may be getting another RM32 billion worth of projects

Ooi’s move follows the appointment of Datuk Thomas Liang Chee Fong — who is said to be Ooi’s close associate — as an executive director of Tatt Giap on April 28 last year. He was redesignated to a non-executive director in September.

The steel products maker’s annual report describes Liang as having experience in corporate restructuring and the rejuvenation of various business entities.

The annual report also stated that it is mulling a number of proposals to strengthen its financial performance, which include venturing into property development on its existing land.

The group’s properties, plants and equipment have a net book value of RM123.17 million, with land and buildings accounting for RM98.9 million.

This includes a 12.6-acre factory in Seberang Perai, which has a market value of RM55 million as at March 30, 2016, and a 5-acre factory in Bukit Minyak worth RM24 million.

Ooi had previously also transformed other listed entities to include property development as their businesses – the former United Bintang Bhd, now Ideal United Bintang International Bhd, was previously a heavy machinery and spare parts trading company that was in the red, before its diversification into property development.

He took the helm as executive chairman, and the company swung back into the black in 2015 when contributions from property eclipsed those from its machinery sales.