Think tank: Scrapping GST may not significantly cut living costs

Although zero-rating the GST may lead to increased spending by the M40 income group, it might not have much impact on the cost of living for the B40 group, says think tank.

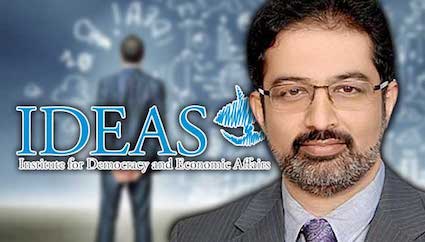

(FMT) – The Institute for Democracy and Economic Affairs (IDEAS) has cautioned that Malaysians may not see a significant reduction in their cost of living with the zero-rating of the goods and services tax (GST).

The think tank said this was because 30 daily-use food items and 19 services, which make up a major part of the household expenses of the bottom 40 (B40) income group, are already zero-rated.

Speaking to FMT, IDEAS acting CEO Ali Salman said the Consumer Price Index (CPI) showed the GST wasn’t the single most important factor in the price increase of food, non-alcoholic beverages, education, health, transport and housing services over the last five years.

However, he expected zero-rating the GST to lead to increased spending by the middle 40 (M40) income group.

He said in addressing the rising cost of living – a primary issue for voters in the recent general election – the new government must come up with more significant measures.

“It needs to invest more in policies to help people raise their income, such as improving labour productivity.

“It would also be good to reduce the government’s role in the economy so that we can have more entrepreneurs.”

At the same time, Ali said, it was also important to prevent a rise in the fiscal deficit.

Universiti Tun Abdul Razak economist Barjoyai Bardai said zero-rating GST was a good temporary solution to reduce prices.

“Although there is no guarantee that the cost of living will go down, at least there will be a decrease in prices of goods by about 6%.

“This will likely lead to an increase in spending among the lower-income group.”

He added that the next consumption tax which may be introduced to replace GST should not burden the lower-income group.

The GST will be zero-rated from June 1. The finance ministry said this would cover all goods produced locally and imported.

Pakatan Harapan had vowed to abolish the GST, introduced on April 1, 2015, as part of its election manifesto.